Growth masks most problems

Hidden second and third order effects of bad management decisions

Scuttlebutt

I first came across this term when I read Philip Fisher’s 1958 book, “Common Stocks and Uncommon Profits and Other Writings” which is also the inspiration behind the name of my little corner of the internet. I read the book during my formative young adult years while I was serving in the army and it left a deep imprint on my subconscious up till today.

When I first stepped into the working world in 2009, it was on the cusp of the Global Financial Crisis and the job market was pretty tough. I went the path of most Accountancy graduates and joined a Big 4 firm’s audit practice. In my mind back then, I knew my place in the world was never going to be in audit, that much was clear from my internship in 2008. However, one cannot afford to be picky during tough times and I decided to make the best of my 2 years in audit (until I become a Senior Associate) before seeking new opportunities when the job market turned around.

Back to the topic of “Scuttlebutt”. During my days as an external auditor, I focused on deriving as much as value as I could out of a pretty mundane scope of work. One of the best things about being an auditor is being able to “roam” across many different industries and get a peek under the hood. My innate rebellious nature and also propensity to be a nosey parker led me to engage in many interactions with my client’s employees that are not necessarily required to perform my job as an audit associate.

The business “grapevine” is a remarkable thing…

Common Stocks and Uncommon Profits and Other Writings, Philip Fisher

One important thing I learnt is that the pantry “auntie” or receptionist knows a lot more than we think. They are “invisible” to most in the office but are tuned in to the pulse on the ground. I enjoyed having my pantry talks with these aunties as they usually provide interesting insights and also clue me in on where I should scrutinise for accounting errors or irregularities.

As a result, I could tailor my own work to focus less on areas where I knew there was low risk based on observation of how the company functioned and redirected my time and effort towards high risk areas. It also taught me that numbers are less important compared to the underlying factors that drive them and its second/ third order effects.

The story behind the numbers

Throughout my career, I have come across many situations where the numbers themselves don’t mean as much as the story behind it. We will do well to remember that most numbers/ metrics are lagging indicators which do not shine a light on budding problems and risks in the business. In certain cases, the numbers serve to obscure these problems.

Real life examples

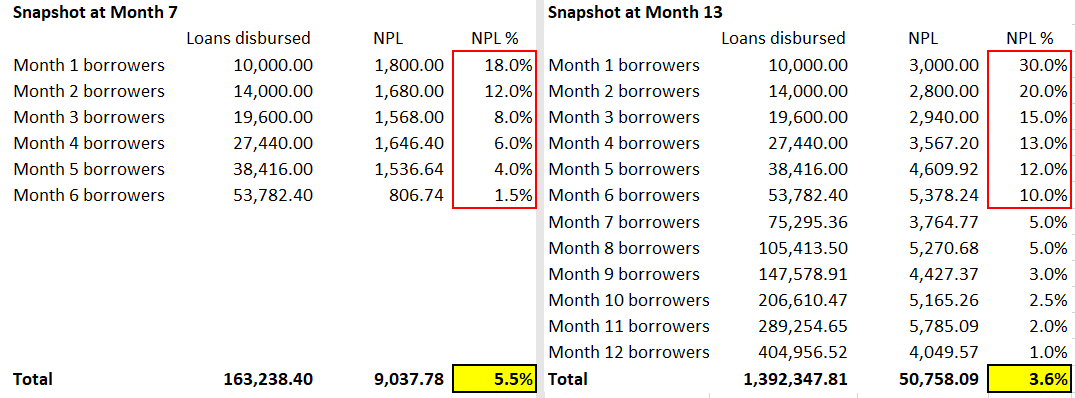

Alternative lending

Above are hypothetical snapshots of the NPL ratios by borrower cohort of an alternative lending company. Overall NPL ratios have decreased from 5.5% to 3.6% and the management proudly wears it as a badge of honour in their pitch to potential investors.

But have they really done well?

Monthly loan disbursements have grown 40% month on month and “blended” NPL ratios are meaningless as defaults typically only show up after 90 days. The story behind the numbers is that of an overly aggressive management who is focused on growing the loan book to fuel fundraising at higher valuations.

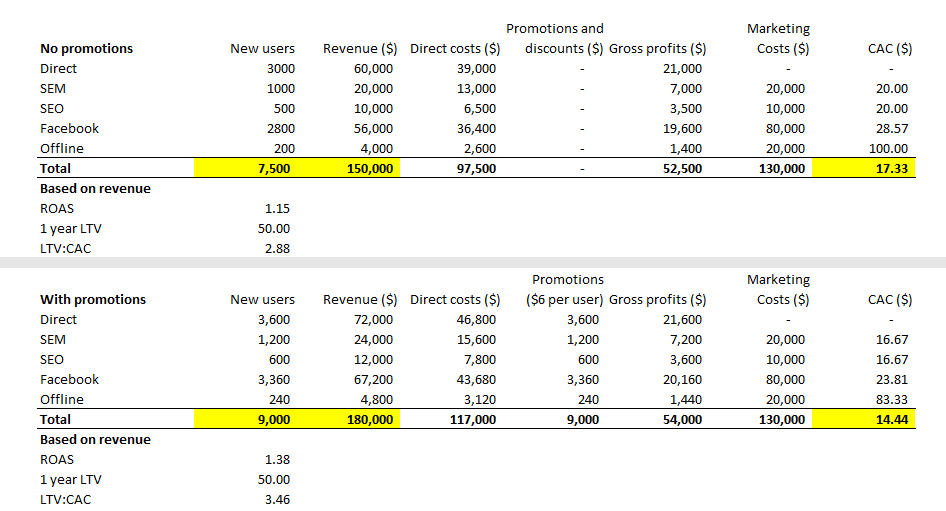

Promotional costs

Here is another hypothetical scenario where management justifies the use of promotions. The product has an average price of $20 per transaction with gross profits at $7 each. Promotions and discounts usually drive conversion rates up by at least 20%, sometimes even more.

Leadership has went through an OKR workshop and it was decided the Marketing’s KPIs are growth in new users , CAC and LTV: CAC ratio.

What do you think are the hidden second and third order effects here?

Second order effect: Marketing meets their KPIs and is encouraged by the “effectiveness” of their campaigns. They scale up the campaigns for the rest of the year. However, gross margins for transactions with promotions goes down to $1 each. Product market fit may be proven (through accelerating traction in user growth and revenue), but at the wrong price point.

Third order effect: The CFO has approved the hiring budget for this year based on a 35% gross margin revenue model. As monthly revenues and users are growing at an increasing rate recently, the CFO has approved for an accelerated hiring of new headcount to bolster the company’s growth efforts.

You should be able to guess where this goes next.

The receding tide reveals

It is all doom and gloom in the media right now, with near daily coverage of companies going through layoffs and cost restructuring.

Although the current COVID 19 induced global recession is orders of magnitude higher in severity and uncertainty, it also heralds the receding of the tide that has lifted many boats across the tech ecosystem.

But one lesson of these episodes of economic tumult is that those surprising ripple effects tend to result from longstanding unaddressed frailties. Crises have a way of bringing to the fore issues that are easy to ignore in good times.

Source: The New York Times

Now, we can see who are swimming without their trunks on.